The convergence of artificial intelligence and banking is reshaping the financial landscape*

The banking industry stands at the precipice of a technological revolution that promises to fundamentally alter how financial institutions operate, serve customers, and manage risk. Artificial Intelligence (AI) has emerged as the most transformative force in modern banking, with the potential to either usher in an era of unprecedented efficiency and financial inclusion or create new systemic risks that could destabilize the global financial system.

As we look toward the future, the debate surrounding AI in banking has crystallized into two distinct camps: the optimists who envision a golden age of personalized, efficient, and accessible financial services, and the pessimists who warn of job displacement, algorithmic bias, and systemic vulnerabilities that could threaten financial stability. The truth, as often happens with transformative technologies, likely lies somewhere between these extremes.

## The Current State of AI in Banking

The financial services industry has become one of the most aggressive adopters of AI technology, investing $35 billion in 2023 alone, with projections indicating growth to $97 billion by 2027—a staggering compound annual growth rate of 29%. This massive investment reflects the industry’s recognition that AI is not merely a technological upgrade but a fundamental reimagining of how banking operates.

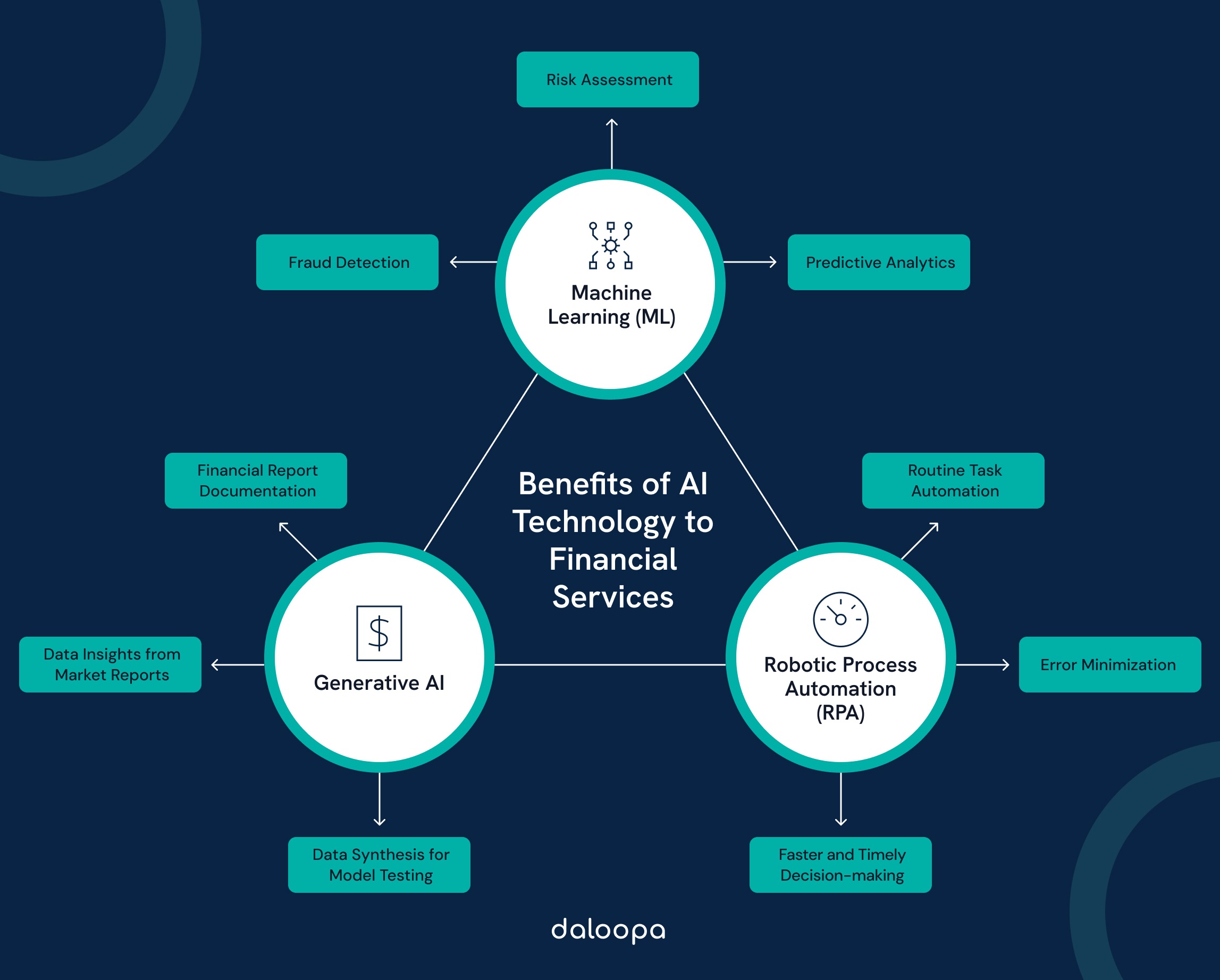

*AI is revolutionizing every aspect of financial services*

Current applications of AI in banking span across multiple domains. Fraud detection systems now process millions of transactions in real-time, identifying suspicious patterns with accuracy rates that far exceed human capabilities. Customer service has been revolutionized through AI-powered chatbots and virtual assistants, with companies like Klarna reporting that their AI assistant now handles two-thirds of customer inquiries while reducing marketing spend by 25%.

Risk management has seen perhaps the most significant transformation, with AI algorithms analyzing vast datasets to improve credit underwriting, predict market volatility, and optimize capital allocation. The technology has enabled banks to process loan applications in minutes rather than days, while simultaneously reducing default rates through more accurate risk assessment.

## The Optimist’s Vision: A Banking Utopia

### Enhanced Efficiency and Cost Reduction

The optimistic perspective on AI in banking paints a picture of unprecedented efficiency gains and cost reductions that will ultimately benefit both financial institutions and their customers. Proponents argue that AI will eliminate the inefficiencies that have plagued traditional banking for decades, creating a more streamlined and responsive financial system.

AI-driven automation is already demonstrating remarkable results in operational efficiency. Document processing, which once required armies of clerks working for days, can now be completed in minutes with greater accuracy. Compliance monitoring, traditionally a labor-intensive and error-prone process, is being transformed through AI systems that can analyze regulatory requirements in real-time and ensure continuous adherence.

The cost savings are substantial. McKinsey estimates that AI could contribute $2 trillion to the global economy through improved operational workflows and risk management in financial services alone. These savings don’t just benefit bank shareholders; they create opportunities for reduced fees, better interest rates, and expanded access to financial services for underserved populations.

### Democratization of Financial Services

Perhaps the most compelling argument from AI optimists is the technology’s potential to democratize access to sophisticated financial services. Traditionally, premium banking services—such as personalized investment advice, complex risk management tools, and tailored financial planning—were available only to high-net-worth individuals who could justify the human resources required to provide such services.

AI changes this equation fundamentally. Robo-advisors can now provide sophisticated investment strategies to customers with modest portfolios, analyzing market conditions, risk tolerance, and financial goals with the same rigor previously reserved for millionaire clients. AI-powered financial planning tools can help ordinary consumers optimize their spending, savings, and investment decisions with insights that were once the exclusive domain of expensive financial advisors.

This democratization extends beyond individual services to entire markets. In emerging economies, AI-powered mobile banking platforms are enabling financial inclusion on an unprecedented scale, allowing people without access to traditional banking infrastructure to participate in the formal financial system. The World Economic Forum notes that AI can help emerging markets leapfrog legacy infrastructure, redefining financial access and inclusion by bypassing traditional systems entirely.

### Hyper-Personalization and Customer Experience

The optimistic vision of AI in banking includes a future where every customer interaction is perfectly tailored to individual needs, preferences, and circumstances. Advanced AI systems will analyze spending patterns, life events, financial goals, and market conditions to provide proactive financial guidance that anticipates customer needs before they’re even expressed.

Imagine a banking system that automatically refinances your mortgage when interest rates drop, rebalances your investment portfolio based on changing market conditions, and alerts you to better insurance options as your life circumstances change. This level of proactive service, powered by AI, could transform banking from a reactive service industry into a proactive financial partner.

Customer service will be revolutionized through AI systems that understand context, emotion, and intent with human-like sophistication. These systems will be available 24/7, speak multiple languages fluently, and maintain perfect memory of every customer interaction, creating a seamless and personalized experience that exceeds what human representatives could provide.

### Innovation and New Business Models

AI optimists envision a future where artificial intelligence enables entirely new business models and financial products that were previously impossible. Synthetic data generation could allow banks to test new products and services without risking real customer data, accelerating innovation while maintaining privacy and security.

Agentic AI—systems capable of making independent decisions and executing actions—could enable “autonomous finance,” where AI agents manage entire financial portfolios, negotiate better rates on behalf of customers, and execute complex financial strategies without human intervention. This could make sophisticated financial management accessible to everyone, regardless of their financial knowledge or resources.

The integration of AI with other emerging technologies, such as blockchain and quantum computing, could create new paradigms for financial services that are more secure, efficient, and transparent than anything currently available.

## The Pessimist’s Warning: A Banking Dystopia

### Job Displacement and Economic Disruption

The pessimistic view of AI in banking focuses heavily on the technology’s potential to eliminate millions of jobs across the financial services sector. Critics argue that while AI may create some new roles, it will destroy far more traditional banking jobs, leading to widespread unemployment and economic disruption.

The numbers are sobering. The World Economic Forum estimates that AI could automate or significantly augment 32-39% of tasks in banking and insurance. While optimists frame this as freeing employees for higher-value work, pessimists point out that many displaced workers may lack the skills necessary to transition to these new roles, creating a permanent class of unemployed former bank employees.

The ripple effects extend beyond the banking sector itself. As AI reduces the need for human workers in financial services, the economic impact will be felt in communities that depend on banking jobs, from small towns with regional bank branches to major financial centers like New York and London.

### Algorithmic Bias and Discrimination

One of the most serious concerns raised by AI pessimists is the potential for algorithmic bias to perpetuate and amplify existing discrimination in financial services. AI systems trained on historical data inevitably inherit the biases present in that data, potentially leading to systematic discrimination against minority groups, women, and other vulnerable populations.

The “black box” nature of many AI systems makes this problem particularly insidious. When a human loan officer denies an application, they can explain their reasoning and be held accountable for discriminatory practices. When an AI system makes the same decision, the reasoning may be opaque even to the system’s creators, making it difficult to identify and correct biased outcomes.

Recent studies have shown that AI systems used in hiring, lending, and insurance can exhibit significant bias against protected classes, often in ways that are subtle and difficult to detect. As these systems become more prevalent in banking, the risk of systematic discrimination increases exponentially.

### Cybersecurity and Systemic Risk

The pessimistic perspective on AI in banking emphasizes the technology’s potential to create new and unprecedented cybersecurity risks. As banks become increasingly dependent on AI systems, they also become more vulnerable to attacks that target these systems specifically.

AI-powered cyberattacks could be far more sophisticated and damaging than traditional hacking attempts. Adversarial AI could potentially manipulate banking algorithms, causing them to make incorrect decisions about lending, trading, or risk management. The interconnected nature of modern banking means that a successful attack on one institution’s AI systems could cascade throughout the entire financial system.

The use of synthetic data and deepfake technology by criminals poses additional risks. As AI becomes better at generating realistic but fake data, it becomes increasingly difficult for banks to distinguish between legitimate and fraudulent information, potentially leading to massive losses from sophisticated scams.

### Loss of Human Judgment and Oversight

Critics worry that the increasing reliance on AI in banking will lead to a dangerous reduction in human judgment and oversight. While AI systems excel at processing large amounts of data and identifying patterns, they lack the contextual understanding, ethical reasoning, and intuitive judgment that human bankers bring to complex financial decisions.

The 2008 financial crisis was partly attributed to the over-reliance on mathematical models that failed to account for human behavior and market psychology. Pessimists argue that an even greater reliance on AI could lead to similar or worse systemic failures, as banks lose the human insight necessary to understand and respond to unprecedented situations.

The “automation bias”—the tendency for humans to over-rely on automated systems—could exacerbate this problem, leading to situations where bank employees blindly follow AI recommendations without applying critical thinking or considering alternative perspectives.

### Regulatory and Compliance Challenges

The rapid pace of AI development in banking is outstripping the ability of regulators to understand and oversee these systems effectively. Pessimists argue that this regulatory lag creates dangerous gaps in oversight that could lead to systemic risks or consumer harm.

The complexity of AI systems makes them difficult to audit and regulate using traditional methods. How can regulators ensure that an AI system is making fair lending decisions when the system’s decision-making process is opaque even to its creators? How can they prevent market manipulation when AI systems can execute thousands of trades per second based on algorithms that are constantly evolving?

The global nature of AI development also creates regulatory challenges, as banks may use AI systems developed in countries with different regulatory standards or ethical frameworks, potentially creating conflicts between local regulations and AI system behavior.

## The Balanced Reality: Navigating Between Extremes

### Current Evidence and Trends

The reality of AI in banking likely lies between the utopian and dystopian visions presented by optimists and pessimists. Current evidence suggests that AI is indeed delivering significant benefits in terms of efficiency, fraud detection, and customer service, but it’s also creating new challenges that require careful management.

Empirical studies show that AI technology innovation positively affects banks’ return on assets, supporting the optimistic view that AI can improve financial performance. However, these same studies also reveal that the benefits can be offset by factors such as regulatory constraints and competitive pressures, suggesting that the impact of AI is more nuanced than either extreme position suggests.

The adoption of AI in banking has been more gradual and deliberate than either optimists or pessimists predicted. Rather than rushing to implement AI across all operations, most banks are taking a measured approach, starting with internal applications and gradually expanding to customer-facing services as they gain experience and confidence with the technology.

### Emerging Governance Frameworks

The banking industry is beginning to develop governance frameworks specifically designed to address the challenges posed by AI. These frameworks focus on ensuring transparency, accountability, and fairness in AI systems while still allowing for innovation and efficiency gains.

Leading banks are implementing AI ethics committees, conducting regular audits of their AI systems for bias and fairness, and developing explainable AI technologies that can provide clear reasoning for their decisions. Regulatory bodies are also beginning to develop AI-specific guidelines and requirements, though this process is still in its early stages.

The development of synthetic data technologies offers a potential solution to some of the privacy and bias concerns raised by pessimists, allowing banks to train AI systems on realistic but artificial data that doesn’t compromise customer privacy or perpetuate historical biases.

### The Path Forward: Responsible AI Implementation

The future of AI in banking will likely be determined by how well the industry manages the balance between innovation and risk management. This requires a commitment to responsible AI implementation that prioritizes transparency, fairness, and human oversight while still capturing the efficiency and innovation benefits that AI offers.

Key principles for responsible AI in banking include:

**Transparency and Explainability**: AI systems used in banking should be able to provide clear explanations for their decisions, particularly in areas like lending and risk assessment where those decisions have significant impacts on customers’ lives.

**Fairness and Non-Discrimination**: Banks must actively monitor their AI systems for bias and discrimination, implementing corrective measures when problems are identified.

**Human Oversight**: While AI can augment human decision-making, it should not replace human judgment entirely, particularly in complex or high-stakes situations.

**Robust Security**: As AI systems become more central to banking operations, they must be protected against both traditional cyberattacks and new AI-specific threats.

**Regulatory Compliance**: Banks must work closely with regulators to ensure that their AI systems comply with existing laws and regulations while also helping to shape new regulatory frameworks for AI.

## Sector-Specific Implications

### Retail Banking

In retail banking, AI’s impact will be most visible in customer service and personal financial management. AI-powered chatbots and virtual assistants will handle routine inquiries and transactions, while more sophisticated AI systems will provide personalized financial advice and proactive account management.

The optimistic view sees this leading to better customer experiences and more accessible financial services. Customers will receive 24/7 support, personalized recommendations, and proactive financial guidance that helps them make better decisions about their money.

The pessimistic view worries about the loss of human connection in banking relationships and the potential for AI systems to manipulate customers into making financial decisions that benefit the bank more than the customer.

### Investment Banking

Investment banking will see AI applications in areas such as algorithmic trading, risk management, and research analysis. AI systems can process vast amounts of market data in real-time, identifying trading opportunities and managing risk with speed and accuracy that human traders cannot match.

Optimists see this leading to more efficient markets, better price discovery, and reduced trading costs that benefit all market participants. AI could also democratize access to sophisticated trading strategies and market analysis.

Pessimists worry about increased market volatility, the potential for AI-driven flash crashes, and the concentration of market power in the hands of firms with the most advanced AI systems.

### Commercial Banking

In commercial banking, AI will transform credit underwriting, cash management, and business advisory services. AI systems can analyze business financial data, market conditions, and economic indicators to make more accurate lending decisions and provide better financial advice to business customers.

The optimistic perspective sees this enabling banks to serve smaller businesses more effectively, providing them with access to credit and financial services that were previously available only to larger corporations.

The pessimistic view concerns the potential for AI systems to make lending decisions based on incomplete or biased data, potentially discriminating against certain types of businesses or industries.

## Global and Regulatory Perspectives

### International Variations

The development and regulation of AI in banking varies significantly across different countries and regions. The European Union has taken a more cautious approach, implementing comprehensive AI regulations that prioritize consumer protection and ethical considerations. The United States has focused more on innovation and competitiveness, with lighter regulatory oversight but greater industry self-regulation.

China has embraced AI in banking more aggressively than most Western countries, with major banks implementing AI systems across a wide range of applications. This has led to significant efficiency gains and innovation, but also raises concerns about privacy and government surveillance.

These international variations create both opportunities and challenges for global banks, which must navigate different regulatory environments while trying to maintain consistent AI strategies across their operations.

### Regulatory Evolution

Banking regulators around the world are grappling with how to oversee AI systems effectively. Traditional banking regulations were designed for human decision-makers and may not be adequate for AI-driven banking operations.

New regulatory frameworks are emerging that focus on AI-specific issues such as algorithmic transparency, bias testing, and model governance. However, the rapid pace of AI development means that regulations often lag behind technological capabilities, creating uncertainty for banks and potential gaps in consumer protection.

The challenge for regulators is to create frameworks that protect consumers and maintain financial stability without stifling innovation or putting domestic banks at a competitive disadvantage relative to international competitors.

## Economic and Social Implications

### Financial Inclusion

One of the most significant potential benefits of AI in banking is its ability to expand financial inclusion. AI-powered mobile banking platforms can provide financial services to people who have never had access to traditional banking, particularly in developing countries where banking infrastructure is limited.

AI systems can assess creditworthiness using alternative data sources, such as mobile phone usage patterns or social media activity, enabling banks to serve customers who lack traditional credit histories. This could bring billions of people into the formal financial system for the first time.

However, there are also risks that AI could exacerbate financial exclusion if the systems are biased against certain populations or if the digital divide prevents some people from accessing AI-powered services.

### Economic Efficiency

AI has the potential to make the banking system significantly more efficient, reducing costs and improving the allocation of capital throughout the economy. More accurate risk assessment could lead to better lending decisions, while automated processes could reduce the time and cost of financial transactions.

These efficiency gains could translate into economic benefits for society as a whole, including lower borrowing costs, better investment returns, and more efficient capital markets.

However, the transition to AI-powered banking could also create economic disruption, particularly for workers whose jobs are automated and communities that depend on traditional banking employment.

### Privacy and Surveillance

The use of AI in banking raises significant privacy concerns, as these systems require access to vast amounts of personal financial data to function effectively. While this data can be used to provide better services, it also creates opportunities for surveillance and privacy violations.

The integration of banking AI with other AI systems, such as those used by governments or other companies, could create comprehensive profiles of individuals’ financial behavior that could be used for purposes beyond banking.

Balancing the benefits of AI-powered financial services with privacy protection will be one of the key challenges facing the banking industry and regulators in the coming years.

## Technological Frontiers

### Agentic AI and Autonomous Finance

The next frontier in AI banking is the development of agentic AI systems that can make independent decisions and take actions on behalf of customers. These systems could manage entire financial portfolios, automatically refinancing loans when better rates become available, rebalancing investments based on market conditions, and even negotiating with other AI systems to secure better deals.

This vision of “autonomous finance” could make sophisticated financial management accessible to everyone, regardless of their financial knowledge or resources. However, it also raises questions about accountability, control, and the potential for AI systems to make decisions that are not in their users’ best interests.

### Quantum Computing Integration

The integration of AI with quantum computing could revolutionize banking by enabling the processing of vastly larger datasets and the solution of complex optimization problems that are currently intractable. This could lead to breakthroughs in areas such as risk management, fraud detection, and algorithmic trading.

However, quantum computing also poses risks to current banking security systems, as quantum computers could potentially break the encryption methods that currently protect financial transactions and data.

### Synthetic Data and Privacy-Preserving AI

The development of synthetic data generation and privacy-preserving AI techniques could address some of the privacy and bias concerns associated with AI in banking. These technologies could allow banks to train AI systems on realistic but artificial data, protecting customer privacy while still enabling innovation.

Federated learning and other privacy-preserving techniques could enable banks to collaborate on AI development without sharing sensitive customer data, potentially accelerating innovation while maintaining privacy and competitive advantages.

## Preparing for the Future

### Skills and Workforce Development

The transformation of banking through AI will require significant investment in workforce development and retraining. Banks will need employees who can work effectively with AI systems, understand their capabilities and limitations, and provide the human oversight necessary to ensure responsible AI use.

This includes not only technical skills but also ethical reasoning, critical thinking, and the ability to communicate complex AI concepts to customers and stakeholders. Banks that invest in developing these capabilities will be better positioned to succeed in an AI-driven future.

### Infrastructure and Technology Investment

The successful implementation of AI in banking requires significant investment in technology infrastructure, including cloud computing platforms, data management systems, and cybersecurity measures. Banks must also invest in the governance and risk management frameworks necessary to oversee AI systems effectively.

This investment is not just about technology but also about organizational culture and processes. Banks must develop new ways of working that integrate AI capabilities while maintaining human oversight and accountability.

### Stakeholder Engagement

The future of AI in banking will be shaped not just by technological capabilities but also by the expectations and concerns of various stakeholders, including customers, regulators, employees, and society as a whole.

Banks must engage proactively with these stakeholders to understand their concerns, address their needs, and build trust in AI-powered banking services. This includes being transparent about how AI systems work, what data they use, and how decisions are made.

## Conclusion: Charting a Course Between Promise and Peril

The future of AI in banking stands at a critical juncture, balanced between transformative promise and significant peril. The optimistic vision of democratized financial services, unprecedented efficiency, and personalized banking experiences is compelling and, in many cases, already becoming reality. The pessimistic warnings about job displacement, algorithmic bias, and systemic risks are equally valid and demand serious attention.

*The future of banking will be shaped by how well we balance innovation with responsibility*

The evidence suggests that neither the utopian nor dystopian extremes are likely to fully materialize. Instead, the future will likely be characterized by gradual transformation, with AI delivering significant benefits while creating new challenges that require ongoing management and adaptation.

The key to navigating this future successfully lies in embracing the principles of responsible AI development and implementation. This means prioritizing transparency, fairness, and human oversight while still capturing the efficiency and innovation benefits that AI offers. It requires collaboration between banks, regulators, technology companies, and civil society to develop governance frameworks that protect consumers and maintain financial stability while enabling innovation.

The banking industry has a unique opportunity to lead by example in the responsible development and deployment of AI. By taking a measured, ethical approach to AI implementation, banks can demonstrate that it’s possible to harness the transformative power of artificial intelligence while maintaining the trust and stability that are essential to the financial system.

The future of banking will be neither the AI utopia envisioned by optimists nor the dystopia feared by pessimists. Instead, it will be shaped by the choices we make today about how to develop, deploy, and govern AI systems in financial services. By choosing wisely, we can create a future where AI enhances rather than replaces human judgment, where technology serves to democratize rather than concentrate financial power, and where innovation proceeds hand in hand with responsibility.

The transformation is already underway, and there is no turning back. The question is not whether AI will reshape banking, but how we will shape AI to serve the best interests of banks, their customers, and society as a whole. The answer to that question will determine whether the future of banking is one of promise fulfilled or peril realized.

As we stand on the threshold of this new era, one thing is certain: the decisions made in the next few years about AI in banking will reverberate for decades to come. The responsibility to make those decisions wisely rests not just with banks and regulators, but with all of us who participate in and depend on the financial system. The future of banking is not predetermined—it is ours to create.

—

*This article represents a comprehensive analysis of current trends and future projections in AI banking. As the field continues to evolve rapidly, ongoing monitoring and adaptation of strategies will be essential for all stakeholders in the financial services ecosystem.*